Managing Cyber Security and Data Privacy Risks for Private Equity Firms

January 26, 2024

Cyber threats are a constant danger. Private Equity (PE) firms are especially vulnerable due to their financial dealings, sensitive data, and data privacy risks associated with their portfolio companies. The cyber threat landscape is evolving rapidly, making PE firms dealing with large transactions, sensitive information, and promising companies even more attractive targets.

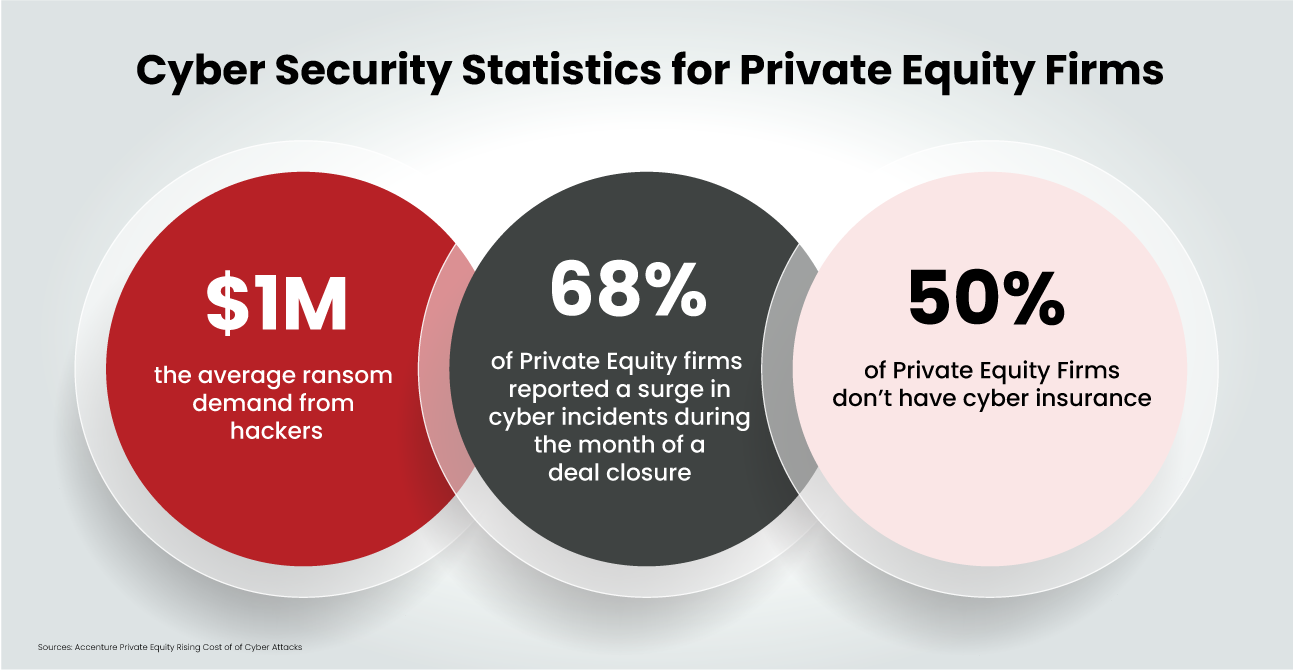

Accenture’s recent insights underscore this pressing reality. Their research reveals a stark sentiment within the business community: a significant 68% of business leaders sense an escalating tide of cyber security risks. Such a pronounced acknowledgment from industry leaders serves as an unequivocal warning beacon. For those who might still harbour reservations or underestimate the gravity of cyber threats, this statistic acts as a wake-up call.

These insights are not mere statistics; they paint a vivid tapestry of vulnerabilities and urgencies.

Private Equity firms must understand the multifaceted risks associated with cyber threats. Data breaches and cyber incidents can have severe consequences for PE operations, both financially and reputationally. These impacts extend far beyond immediate financial losses.

Successful PE firms thrive on a strong reputation, built through strategic investments, due diligence, and unmatched expertise. However, this reputation is not merely about fiscal prudence or astute decision-making; it’s intricately tied to cyber security resilience.

When a portfolio company falls victim to a cyberattack, the ripples of damage extend swiftly and widely. Stakeholders, including investors, partners, and customers, view such incidents not merely as isolated technical glitches but as glaring vulnerabilities. For the PE firm overseeing this portfolio company, the fallout is twofold: immediate scrutiny of its due diligence processes and a tarnished reputation that erodes trust. The ripple effect of such reputational damage can deter future investment opportunities, strain existing partnerships, and diminish the firm’s standing within the competitive PE landscape.

The financial repercussions of cyberattacks are palpable, often materialising in unexpected ways that disrupt PE firms’ strategic trajectories.

Cyber incidents can have far-reaching consequences for PE firms, affecting not only their finances but also their reputation and growth. As cyber security risks intensify, PE firms must adapt their risk management strategies. By prioritising resilience, diligence, and proactive mitigation, they can protect their reputation and financial viability.

Private equity firms must prioritise regulatory compliance to mitigate risks and maintain operational integrity. Data protection and cyber security regulatory frameworks, including the UK’s Data Protection Act 2018, the UK-specific elements of the General Data Protection Regulation (GDPR), and the Network and Information Systems (NIS) Regulations, impose stringent requirements on data protection, privacy, and cyber security resilience.

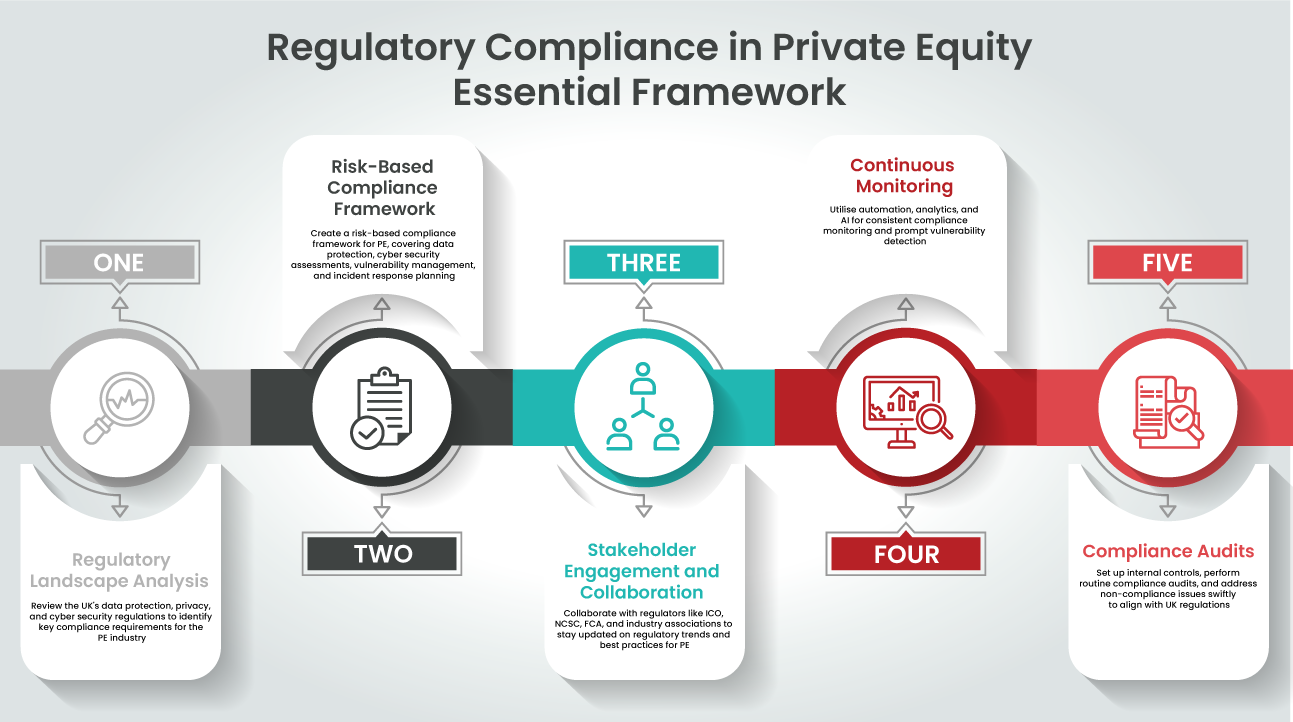

Non-compliance with regulatory obligations exposes PE firms to severe financial penalties, legal repercussions, and reputational damage. This underscores the importance of proactive compliance strategies tailored to the UK regulatory landscape. Moreover, the evolving regulatory environment necessitates a comprehensive approach encompassing:

Conduct a thorough analysis of the UK’s regulatory framework, covering data protection, privacy, and cyber security regulations. Identify key compliance requirements, timelines, and potential impact areas for the PE industry.

Develop a risk-based compliance framework encompassing data protection impact assessments, cyber security risk assessments, and vulnerability management. Include incident response planning to proactively address regulatory obligations.

Foster collaboration with regulators, industry associations, and stakeholders, including the Information Commissioner’s Office (ICO), National Cyber Security Centre (NCSC), Financial Conduct Authority (FCA), and other industry bodies. This collaboration helps stay abreast of emerging regulatory trends, interpretive guidance, and best practices.

Implement robust monitoring mechanisms using automation, analytics, and artificial intelligence tools. Regularly assess ongoing compliance and promptly identify potential vulnerabilities.

Establish comprehensive internal controls and conduct regular compliance audits. Utilise insights from audits to remediate non-compliance issues promptly, ensuring alignment with the UK regulatory landscape.

While 27% of business leaders are confident in their organisation’s cyber resilience, many are not fully prepared. This disparity emphasises the imperative for PE firms to prioritise regulatory compliance and enhance cyber resilience. They should align risk management strategies with the evolving regulatory environment.

PE firm can enhance their cyber resilience and build trust with stakeholders by integrating regulatory compliance into their risk management strategies. Aligning compliance with resilience and diligence fosters a culture of regulatory adherence and innovation, allowing PE firms to navigate the complexities of the digital landscape effectively.

Private Equity firms need a proactive, strategic, and comprehensive approach to cyber security. Implementing best practices tailored to the unique complexities of the PE industry helps firms mitigate risks effectively. It also safeguards sensitive information and maintains stakeholder trust.

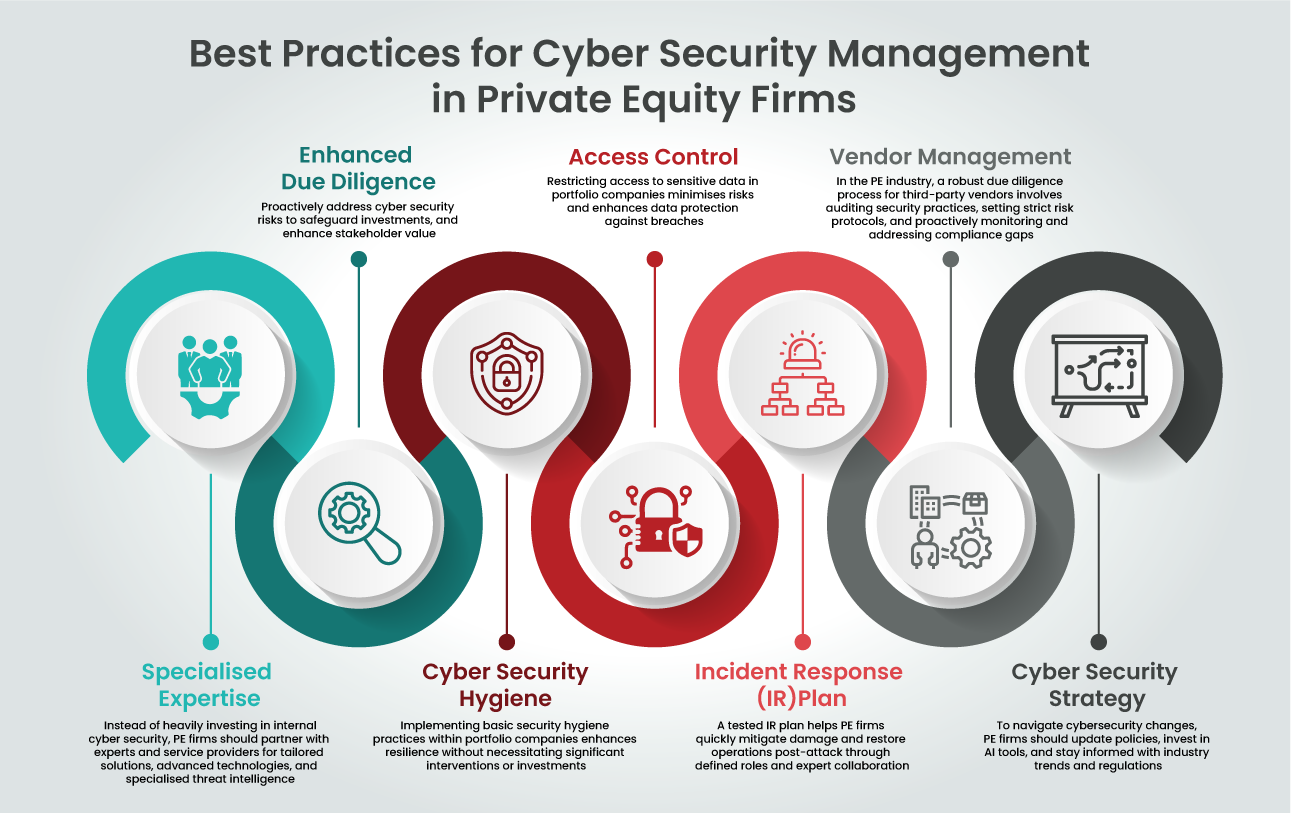

Rather than investing heavily in building internal cyber security capacity, PE firms should consider leveraging specialised expertise and external partnerships. Collaborating with cyber security experts, managed service providers, and industry-specific consultants enables PE firms to access advanced technologies, threat intelligence, and best practices. These are tailored to their unique risk profiles and operational requirements.

Streamlining due diligence processes to expedite deal closures necessitates a strategic balance between speed and security. Limiting due diligence timelines to a week while intensifying remediation opportunities before announcing deals ensures thorough risk assessments, vulnerability assessments, and compliance evaluations. This approach enables PE firms to identify, mitigate, and address potential cyber security risks proactively, protecting investments and enhancing stakeholder value.

Implementing basic security hygiene practices within portfolio companies enhances resilience without necessitating significant interventions or investments. This includes:

Reviewing and limiting access to sensitive information within portfolio companies minimises exposure, mitigates risks, and enhances data protection capabilities. Implementing robust access control mechanisms, user permissions, and privilege management strategies ensures that only authorized individuals can access, modify, or transmit sensitive data. This helps reduce the risk of insider threats, unauthorised access, and data breaches.

Developing and maintaining a tested, coordinated, and comprehensive incident response plan enables PE firms to mitigate the damage and restore operations effectively. This helps minimise disruptions post-attack. This involves:

Given the collaborative nature of the PE industry, establishing a rigorous due diligence process for third-party vendors, partners, and service providers is vital. This includes:

PE firms need a proactive cyber security strategy to stay ahead of the curve. This should include:

By embracing these best practices, Private Equity firms can strengthen their cyber security posture and mitigate data privacy risks effectively.

PE firms are at the forefront of cyber threats due to their sensitive data and proprietary information. The potential damage to their reputation and finances highlights the need for a proactive, strategic, and comprehensive approach to cyber security and data privacy risk management. This is where specialised PE cyber security consulting can be invaluable.

PE firms can mitigate risk and protect their investments by:

By also investing in incident response readiness, access control, and future-proof cyber strategies, PE firms can navigate regulatory environments, emerging technologies, and evolving threats effectively. This proactive strategy gives them a competitive advantage in cyber security.

Cyber security doesn’t have to be complicated. Discover how OneCollab can simplify your cyber security posture and navigate regulatory complexities. Contact us today for a tailored consultation. By partnering with OneCollab, you can take control of your cyber security and data privacy risks, foster resilience and compliance, and position your business for success.

Cyber security shouldn’t be a headache. Get clear and actionable insights delivered straight to your inbox. We make complex threats understandable, empowering you to make informed decisions and protect your business.

Call us +44 20 8126 8620

Email us [email protected]