Protecting Investments: The Importance of Cyber Security for Small Businesses

November 13, 2023

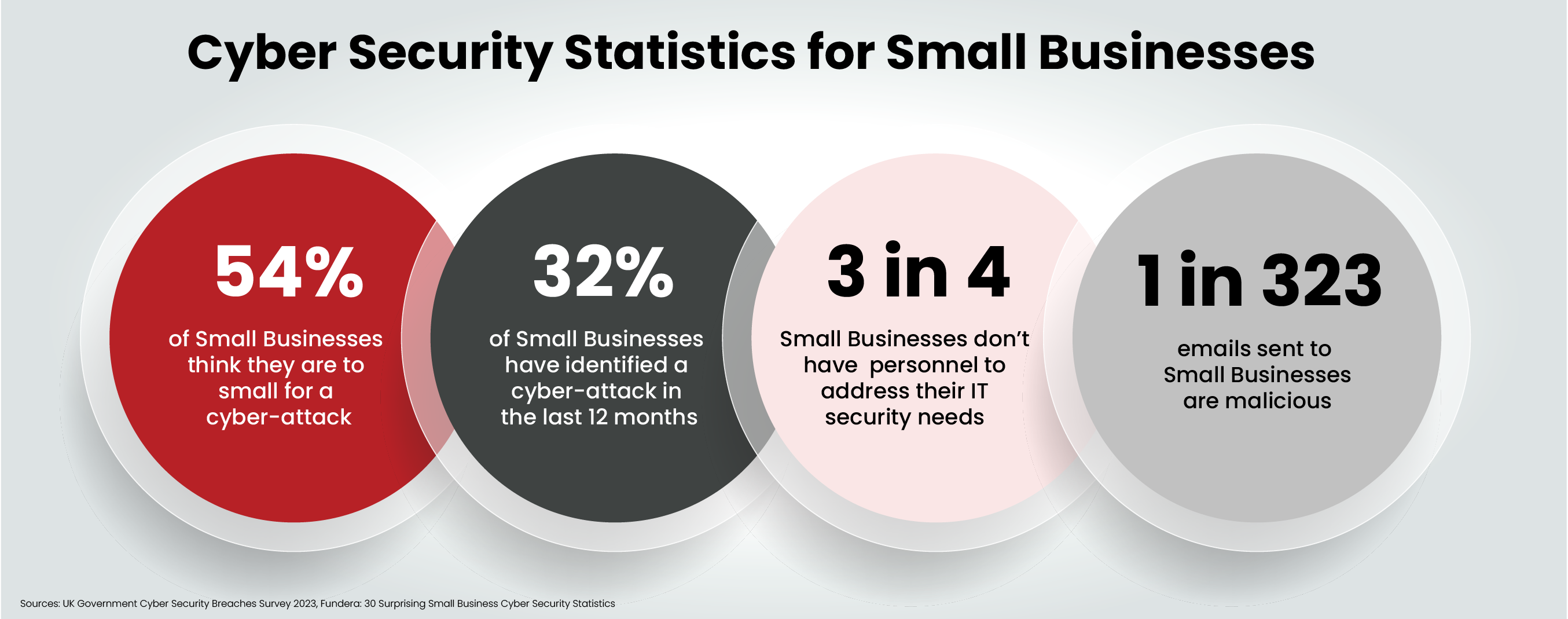

Cyber threats aren’t just a problem for big corporations and governments – even small businesses are equally vulnerable, often facing heightened risks due to limited resources. Shockingly, 32% of small businesses have reported a cyberattack in the past 12 months, yet 3 out of 4 small businesses lack the personnel to address their IT security needs. This underscores the urgent necessity for robust cyber security for small businesses.

For private equity firms, ensuring that their portfolio companies are well-protected against cyber threats is crucial. Navigating the complexities of cyber security can be overwhelming for small businesses, especially with limited resources. However, by leveraging managed cyber security services that simplify these challenges, private equity firms can effectively mitigate risks and enhance the security posture of their investments.

Cyber security is not merely an option but a necessity for small businesses. It acts as a shield, protecting sensitive data, financial stability, reputation, and legal compliance while maintaining a competitive edge and ensuring uninterrupted business operations. For private equity firms, understanding and addressing these aspects is crucial for protecting and enhancing the value of their investments.

Small businesses often handle sensitive customer information, financial records, and proprietary data. Effective cyber security measures are essential to protect this valuable information from theft, breaches, and unauthorised access. Ensuring robust data protection within portfolio companies helps maintain their integrity and trustworthiness.

Cyberattacks can be financially devastating for small businesses. The cost of recovering from an attack, including potential legal fees, fines, and loss of revenue, can be substantial. Many small businesses lack the financial resilience to absorb these unforeseen costs. For private equity firms, this highlights the importance of ensuring their portfolio companies are well-protected to safeguard their investments and avoid significant financial losses.

A data breach can severely damage a small business’s reputation. Customers may lose trust in a company that cannot secure their data, leading to a loss of both customers and revenue. Protecting the reputation of portfolio companies is crucial for maintaining their market value and attractiveness to future buyers, directly impacting the exit strategy of private equity firms.

Small businesses are subject to various data protection and privacy regulations, such as GDPR. Failing to comply with these regulations can lead to legal consequences and significant fines. Ensuring compliance within portfolio companies is vital for avoiding legal risks and potential financial penalties, thereby protecting the firm’s investment.

Demonstrating robust cyber security practices can provide small businesses with a competitive edge in the market. It becomes an attractive selling point, drawing in customers who prioritise the safety of their valuable data. For private equity firms, this can enhance the value proposition of their investments, making them more appealing to potential buyers.

Small businesses often collaborate with larger organisations and can be vulnerable to cyberattacks through their connections. Ensuring strong cyber security can protect not only the business itself but also its partners and suppliers, thereby safeguarding the entire supply chain. This is crucial for maintaining the operational stability of portfolio companies.

Costly ransomware attacks increasingly targeted small businesses. Robust cyber security can help prevent such incidents or mitigate their impact, protecting the financial health of the business. For private equity firms, this means protecting their investments from potentially crippling financial demands.

Small businesses may have limited resources to recover from a cyber incident. Prevention and proactive cyber security measures are often more cost-effective than dealing with the aftermath of an attack. Investing in preventative measures can protect investments from significant financial losses and ensure the long-term viability of portfolio companies.

Cyberattacks can disrupt operations, causing downtime and lost productivity. Small businesses need cyber security measures to ensure business continuity and minimise disruptions. This is crucial for maintaining the operational efficiency of portfolio companies, which directly affects their profitability and attractiveness to future buyers.

Insider threats should not be overlooked. Many small business cyber security incidents result from employee errors or negligence. Educating staff about cyber security best practices is crucial to reducing these risks. For private equity firms, ensuring that portfolio companies implement comprehensive training programmes can significantly enhance their security posture and protect the firm’s investments.

The aftermath of a cyberattack on a small business can be catastrophic, with a spectrum of substantial consequences that can significantly impact both the business and its investors. These include:

Cyberattacks can result in significant financial losses arising from the theft of sensitive banking information or the disruption of regular business operations. For private equity firms, this means potential losses in the value of their investments and increased financial risk.

Restoring and fortifying a network’s security can be costly. This includes expenses associated with eliminating threats, enhancing digital defences, and seeking consultancy from cyber security experts. These costs can strain the financial resources of small businesses, affecting their profitability and, consequently, the returns for private equity investors.

Disclosing to customers that their information has been compromised can inflict severe damage to a business’s reputation, undermining trust and potentially driving customers away. Reputational damage to portfolio companies can reduce their market value and attractiveness to future buyers, complicating exit strategies.

For small businesses, cyberattacks can be a fatal blow, but it is possible to defend against them. Here are our top cyber security tips tailored for small businesses, which are also crucial for private equity firms to consider when managing their portfolio companies:

Begin with a thorough evaluation of potential risks that could compromise your company’s networks, systems, and sensitive information. Conducting a cyber health check will help identify and analyse potential threats, providing the foundation of your cyber security strategy. Regularly review and update this strategy, especially when making changes to information storage and usage, ensuring that data remains protected.

Employees can leave your business vulnerable to an attack. A considerable number of data breaches result from insider actions, whether through malicious intent or carelessness. Employees may lose company devices, disclose login credentials, or inadvertently open fraudulent emails, leading to potential cyber threats.

To mitigate these risks, invest in cyber security training for your staff. Educate them on the importance of using strong, unique passwords, and how to identify and avoid phishing emails. Establish clear policies outlining the handling and protection of customer information and other vital data.

Endpoint protection is a fundamental pillar of a cyber security plan that protects users and data. It is crucial to any organisation and one of the most effective ways of protecting devices against harmful web downloads, ransomware, and malicious applications.

Endpoint protection solutions protect endpoints such as PCs, laptops, servers, mobiles, and IoT (Internet of Things) devices from malware, phishing, malicious applications, and zero-day attacks. They also enable IT teams to investigate and remediate security incidents, respond to alerts, and configure device policies, ensuring the integrity and security of your organisation’s digital infrastructure.

Firewalls are essential for protecting both hardware and software. These defences act as a barrier to block or deter viruses from infiltrating your network. They play a vital role in protecting your network traffic, both inbound and outbound, by preventing unauthorised access and stopping hackers from exploiting vulnerabilities.

Additionally, it is imperative to install anti-ransomware software, which provides a robust defence against ransomware that may bypass other security measures, ensuring the safety of your critical data.

Spam email protection is a vital component of modern-day cyber security, especially for small businesses. Robust email filtering systems are instrumental in identifying and blocking suspicious messages before they reach employees’ inboxes. By employing techniques such as content analysis, sender verification, and blacklisting known malicious domains and IP addresses, these filters effectively screen out spam emails, reducing the risk of data breaches stemming from phishing attempts.

One of the best cyber security tips for small business owners without a full-fledged tech team is to ensure your security software is up to date. If you don’t regularly check for updates, your digital assets could become vulnerable to an attack. Automatic updates are extremely helpful, in speeding up this process.

By keeping your digital assets current, you thwart cybercriminals who often exploit outdated systems. This simple step safeguards vital business data from breaches and builds a trustworthy relationship with customers.

Data backups are not merely advisable; they are crucial in securing critical data. Ensure to back up data to a secure location, such as an off-site server or cloud storage, and test these backups regularly to ensure they can be restored if needed. This strategy eliminates the risk of data loss in the event of a cyberattack.

Strong, unique passwords are a cornerstone of cyber security. Encourage the use of passwords that are at least 12 characters long and incorporate alphanumeric characters, both uppercase and lowercase letters, and symbols. Crucially, passwords should be unique for every login, avoiding the use of modified versions of the same password across multiple accounts. Simplify the management of complex passwords by utilising password managers, enhancing good password hygiene among employees.

MFA should be an integral part of your cyber security practices. Requiring multiple authentication factors, such as a password and a mobile device confirmation, adds an additional layer of protection. Even if a password is compromised, an attacker would need an extra factor to access an account. Modern cloud-based MFA solutions are user-friendly and do not require specialised hardware.

With the increasing use of mobile devices in business operations, mobile security is vital. Employ Mobile Device Management (MDM) and Mobile Application Management (MAM) to secure both the devices and applications your employees use. MDM enables remote monitoring, management, and configuration of devices, while MAM offers control over the apps on those devices, mitigating potential security risks.

Within your business, restrict the number of individuals with access to critical data to a minimum. Employees should have access only to data they need for their specific roles. Implement a system of separate user accounts for each employee, each with the privileges they require.

This approach minimises the impact of a data breach and reduces the possibility of malicious actions from within the company gaining authorised access to data. Establish a clear plan that outlines which individuals have access to certain levels of information, ensuring roles and accountability are transparent to all involved.

In the event of a cyberattack, an IR plan is a critical component in resolving the issue swiftly and effectively. This plan should provide guidelines on how to detect, respond to, and recover from data breaches or network security issues, ensuring your business can effectively defend itself against the detrimental effects of a cyberattack.

By implementing these cyber security measures, small businesses can significantly enhance their resilience against cyber threats and protect their valuable data and operations. For private equity firms, ensuring that portfolio companies adopt these practices is essential for protecting investments and maintaining operational stability.

Get started on your cyber security journey by downloading our Cyber Security Checklist for Small Businesses.

Cyber security for small businesses is not just a necessity but a critical component of business success, especially for those within private equity portfolios. The complexities of cyber security can be daunting, but with the right strategies and support, these challenges can be effectively managed.

By implementing robust cyber security measures, private equity firms can protect their investments, enhance the value of their portfolio companies, and ensure long-term operational stability. Don’t let cyber threats undermine your business potential.

We simplify the complexities of cyber security. Book a discovery call to learn how we can help streamline your cyber security needs and protect your investments. Together, we can build a secure and resilient future for your portfolio companies.

Cyber security shouldn’t be a headache. Get clear and actionable insights delivered straight to your inbox. We make complex threats understandable, empowering you to make informed decisions and protect your business.

Call us +44 20 8126 8620

Email us [email protected]